The appetite for investment in schools worldwide seems unabated.

There are five key elements that should be used to gauge the viability of a school purchase. Financial Position, Management, Market Growth Potential, Facilities and Valuation. We will share our key criteria and measures over the following series of 5 blog posts to help you narrow down the field.

Should You Buy A School Based On Valuation?

Selling a school can be a difficult decision for investors and entrepreneurs to make, both on an emotional and financial level. There are a number of factors that come into play when determining an appropriate asking price, including competitive advantages, growth opportunities, and historic financial performance.

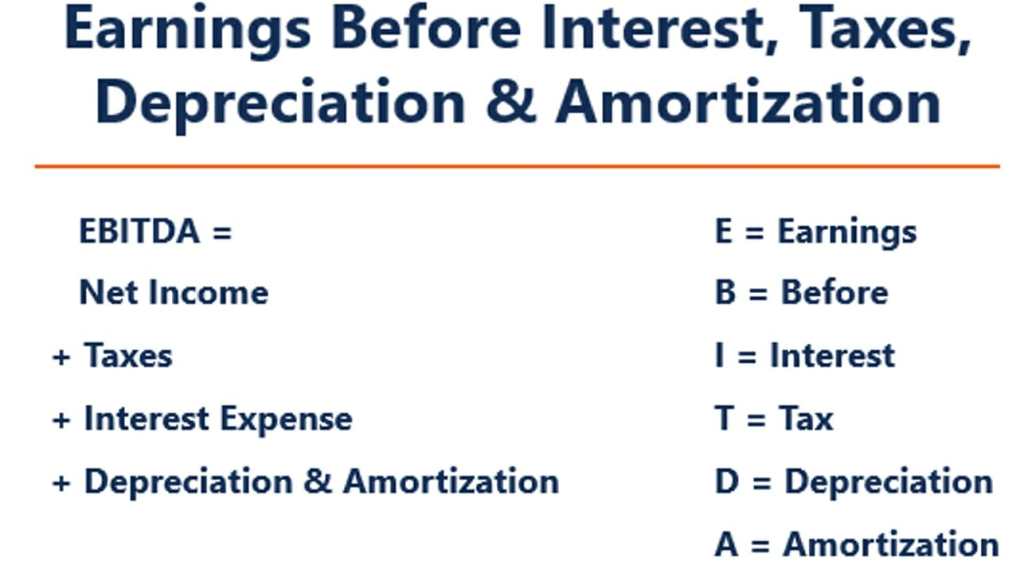

However, one valuation metric in particular, EBITDA, can be a great starting point in measuring a company’s potential value. It is commonly used to determine a sale price so it is important to understand how this valuation metric will be used to calculate the worth of their company.

What is EBITDA?

EBITDA — or earnings before interest, tax, depreciation, and amortization — is an indicator commonly used by prospective buyers or investors to measure a company’s financial performance.

In its simplest form, EBITDA is calculated by adding the non-cash expenses of depreciation and amortization back to a company’s operating income. Below is the basic formula:

EBITDA = Operating Profit (EBIT) + Depreciation (D) + Amortization (A)

It is a simple approximation of the cash flow generated by a school in a given period of time and will help you determine: Should You Buy That School Based on Valuation?

There is a lot of further information available online

Using EBITDA to Strike a Deal

If a school is in a high-growth market, it can expect an offer that is several times its most recent EBITDA. What are typical multiples? It is foolhardy in current markets to make assumptions about “typical” multiples of EBITDA. The range is so broad and there are so many factors that influence this. A stand alone school might attract a lower EBITDA, however large K-12 schools, school groups and schools in fast growing markets are attracting much higher multiples. It really comes down to how much you are prepared to pay, for that location, context and the current economy. It may be determined by current EBITDA, future projected EBITDA or using an average of the company’s EBITDA over the past few years as a base number.

The EBITDA will be determined based on the company’s overall financial performance and a well prepared financial statement.

Comparing EBITDA Multiples

If you research data about common EBITDA multiples paid across different industries you will find a wide range of results: EBITDA Multiples Based On Industry.

It is difficult to make fair comparisons and even within the “education industry” it can be misleading. For example, you certainly cannot compare a K-12 school with a language school. K-12 schools include significant assets and income is secured by a model that requires children to attend for 13 years or more. A language school sells its services to a smaller clientele sometimes in products of just 200hrs. We would argue that it is almost another industry all together. Similarly it is difficult to compare a school in a high growth market like Vietnam with private schools in the USA or the UK. Do some research but filter the results with the support of both financial experts and specialist in the K-12 education industry.

Can EBITDA be Misleading?

EBITDA can also be misused. Let’s take the example of an industry that has assets that depreciate. If the depreciation schedule of assets is extended significantly eg. 5 years to 10 years the profit will jump in the current period because less depreciation is charged. Companies have also been known to change regular expenses to assets so they could depreciate them. This removes the expense and increases depreciation so they can inflate their EBITDA. EBITDA can be manipulated so it does not always truly reflect what is happening in companies. EBITDA must also be compared to cash flow to insure that EBITDA does actually convert to cash as expected. Should You Buy That School Based on Valuation is more complicated than just 1-2 calculations.

Other methods to consider and include:

Asset Value: What is the value of all assets owned by the school? The value of assets will include all equipment and inventory less any debts or liabilities against those assets. The value of these assets is a starting point for determining the business’s worth but obviously only part of the picture. How much revenue and earnings the school produces determines worth. These assets, would otherwise produce little value for any other purpose unless transformed or modified. eg. A school transformed into residential housing, hospitality or other purpose.

Revenue: How much revenue does the school generate from tuition fees and other services? The revenue will be an important factor to determine value and sometimes will be used as a multiple to determine a sale price.

Discounted Cash-flow Analysis: The discounted cash-flow analysis is a complex formula that considers at the business’s annual cash flow projected into the future. It then discounts the value of the future cash flow to today, using a “net present value” calculation. There are many calculators available online as well as comprehensive explanations to help you calculate using this method.

More Than Just Science: It is important not just to base your assessment of the business’s value using number crunching. Geographical location, brand value, facilities, growth market potential all play an important part. In many cases a buyer will determine price based on potential strategic value and business synergies. This is why comparison of EBITDA multiples are proven to be just a guide and consideration.

Should You Buy That School Based On Valuation?

There are five key elements that should be used to gauge the viability of a school purchase. We will share our key criteria and measures over the following series of blog posts to help you narrow down the field.

You might also consider setting up a new school

Education Management

Market Growth Potential

Facilities

Financial Position

Global Services in Education

Contact GSE now for advice in setting up a school, managing a school, training and development, school acquisitions. All major regions of the world!

Who is Global Services in Education (GSE)

Global Services in Education is a full service education management company led by education experts. They are proven education and business leaders who know how to set up and manage international schools in unique cultural contexts. GSE lead education projects from the initial idea to set up and full management. Kindergarten, Primary, Middle and High School, Universities and Adult education.

School Acquisition: GSE represents investors looking to acquire schools or evaluate potential of school group expansion.

Recent Comments